How To Reconcile A Transaction Again In The Register In Quickbooks.

Learn how to reconcile your accounts and then they ever friction match your banking company and credit card statements.

Just like balancing your checkbook, you need to review your accounts in QuickBooks to make sure they friction match your bank and credit bill of fare statements. This process is called reconciling.

When you accept your bank statement in hand, yous'll compare each transaction with the ones entered into QuickBooks. If everything matches, yous know your accounts are counterbalanced and accurate. We recommend reconciling your checking, savings, and credit card accounts every month. Hither's how to get started. Or cheque out our complete reconciliation guide .

Step 1: Review your opening balance

If yous're reconciling an account for the first time, review the opening balance . It needs to match the balance of your existent-life banking company account for the day you decided to start tracking transactions in QuickBooks.

Or, if you forgot to enter an opening balance in QuickBooks in the by, don't worry. Here's how to enter an opening residuum later on .

Need more info? Learn more than about opening balances .

Step 2: Outset a reconciliation

In one case y'all take your monthly bank or credit carte du jour statement, you tin outset reconciling. If you're reconciling multiple months, do them 1 statement at a time starting with your oldest argument:

- If your accounts are connected to online cyberbanking , make sure you match and categorize all of your downloaded transactions.

- In QuickBooks Online, select Settings ⚙ and thenReconcile. If y'all're reconciling for the very first time, select Go started to continue.

- From the Account ▼ dropdown, select the account y'all want to reconcile. Make sure it'due south the aforementioned one on your statement.

Important: If you meet a message nearly a previous reconciliation, select We can assistance you lot fix it. Yous demand to fix this earlier you start.

- Review the Showtime balance. Make certain the beginning balance in QuickBooks matches the i on your argument. Hither's what to do if they don't match .

- Enter the Ending rest and Ending engagement on your statement. Some banks call the ending residue a "new rest" or a "closing residuum".

- If you see it, review theTerminal statement ending date. This is the end date of your last reconciliation. Your current bank statement should start the day later on.

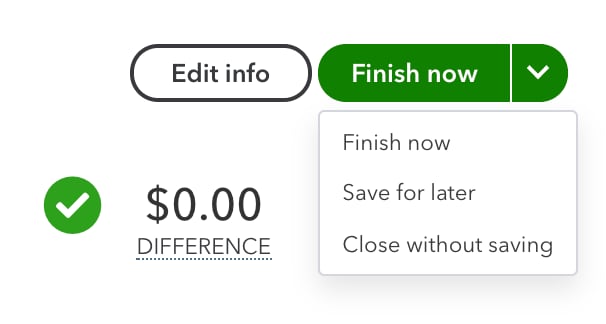

- When you're ready to start, select Start reconciling.

Step 3: Compare your statement with QuickBooks

At present, merely compare the transactions on your statement with what's in QuickBooks. Go over them one-by-one. The catchy office is making certain yous take the right dates and transactions in QuickBooks so you know everything matches.

Follow the section for the type of account you're reconciling:

Reconcile accounts connected to online banking

Reconcile accounts that aren't connected to online banking

Next steps: Review by reconciliations

Run a reconciliation written report to review your work:

- Go to Bookkeeping or Accounting, then Reconcile ( Take me there ).

- Select History past account.

- Use the dropdown menus to select the account and date range. Or impress or export your reconciliation reports if you lot need to share them.

Edit completed reconciliations

You lot tin make changes to by reconciliations , but be conscientious. Changes can unbalance your accounts and other reconciliations. Information technology also affects the beginning balance of your next reconciliation.

Start by reviewing a previous reconciliation report . If y'all reconciled a transaction past fault, here's how to unreconcile it . If you lot adjusted a reconciliation past mistake or need to start over, achieve out to your accountant. These kinds of changes become complicated.

Your books done right - guaranteed.

Go a QuickBooks-certified bookkeeper to categorize transactions and reconcile your depository financial institution statements every month then your books are always 100% accurate. Learn more about QuickBooks Alive Bookkeeping .

Source: https://quickbooks.intuit.com/learn-support/en-us/help-article/statement-reconciliation/reconcile-account-quickbooks-online/L3XzsllsK_US_en_US

Posted by: staffordcood1937.blogspot.com

0 Response to "How To Reconcile A Transaction Again In The Register In Quickbooks."

Post a Comment